Each year we ask small business owners what they expect for the forthcoming year via our annual Business Expectations survey.

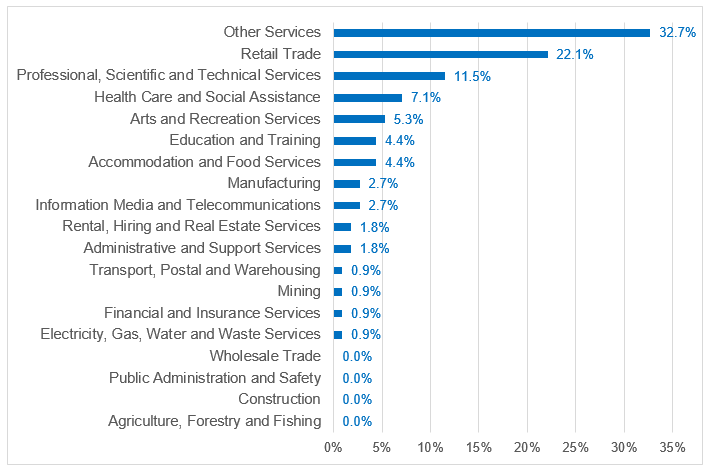

Our 2021 survey was completed by 113 respondents from small business across a range of sizes. Of those surveyed:

- 59 respondents had no employees

- 38 had 1-4 employees

- 13 had 5-19 employees

- 5 had 20+ employees

Chart 1: Industry breakdown of survey respondents

2021 Business Expectations survey results

- Impact of the economy

- Overall sales/revenue

- Unit cost of materials and supplies

- Selling price

- Business profitability

- Cost of employing staff

- Ability to find and retain suitable staff

- Expected changes to the business

- Challenges for 2021

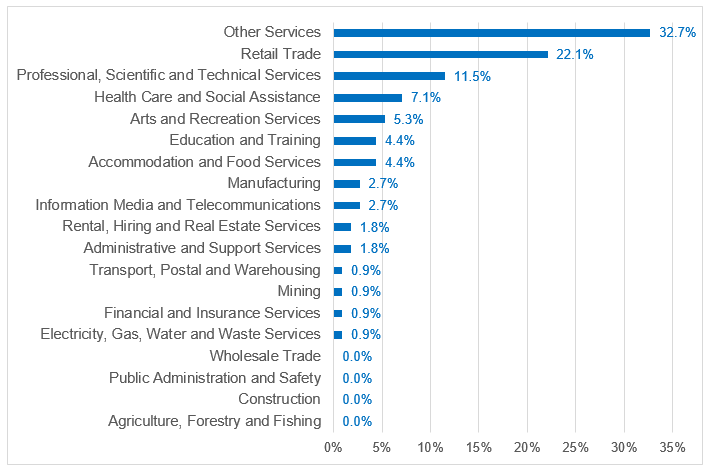

1. Impact of the economy

Respondents were asked whether they believed the economy would have a positive, negative or neutral impact on their businesses in 2021. The level of negative sentiment has risen significantly in 2021, with 56.6 per cent of businesses expecting a negative impact. This was up from 34.8 per cent in 2020. This sharp increase can be attributed to the COVID-19 pandemic which has resulted in a lot of business uncertainty. Interestingly 36.3 per cent of businesses are expecting the economy to have a positive impact, dropping from 40.6 per cent in 2020.

Chart 2. Expected impact of the economy on respondents' businesses over the next 12 months

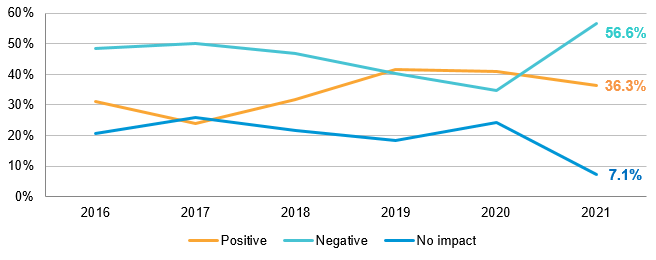

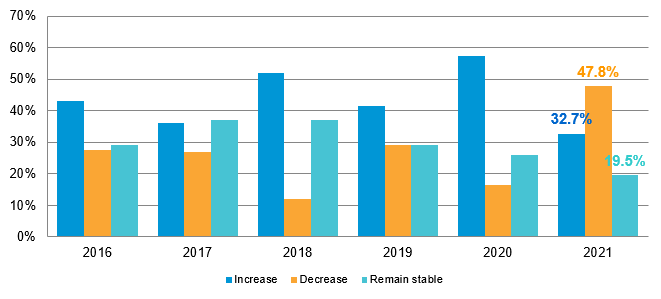

2. Overall sales/revenue

Almost a third of respondents (32.7 per cent) indicated they expected an increase in the overall sales/revenue of their business over the year ahead, down from 57.4 per cent last year. Just under a fifth of respondents (19.5 per cent) indicated they expected their sales/revenue to remain relatively stable in 2021, while 47.8 per cent expected a decrease in the next 12 months (up from 16.5 per cent in 2020).

Chart 3: Expected sales/revenue of respondents' businesses over the next 12 months

3. Unit cost of materials and supplies

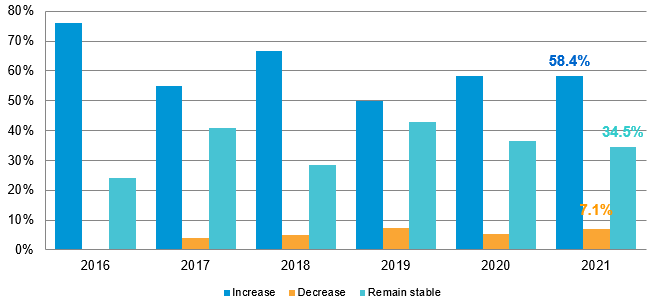

Over half of the respondents (58.4 per cent) indicated that they expected the cost of materials and supplies to increase this year, remaining steady from 2020 (58.3 per cent). Just under a third are expecting costs to remain stable, while only 7.1 per cent anticipate a decrease. These levels are similar to last year’s expectations.

Chart 4: Respondents' expectations of the cost of materials and supplies

4. Selling price

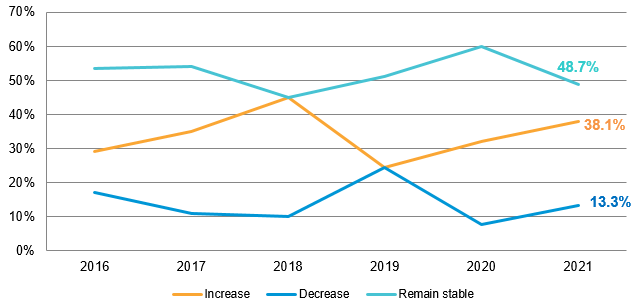

This year sees 48.7 per cent of respondents expecting their selling prices to remain stable over the next 12 months, down from 60 per cent in 2020. Almost two in five respondents (38.1 per cent) are expecting an increase in their selling price, while 13.3 per cent expect their selling price to decrease.

Chart 5: Respondents' expectations for their businesses' selling price over the next 12 months

5. Business profitability

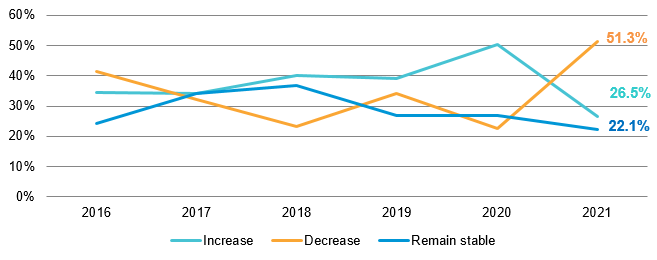

Respondents are worried about the expected profitability of their businesses, with just over half (51.3 per cent) expecting a decrease in profitability in 2021, up from 22.6 per cent in 2020. More than a quarter of respondents (26.5 per cent) anticipate an increase in profitability for the year ahead, while 22.1 per cent are expecting profitability to remain stable.

Chart 6: Respondents' expectations for the profitability of their businesses over the next 12 months

6. Cost of employing staff

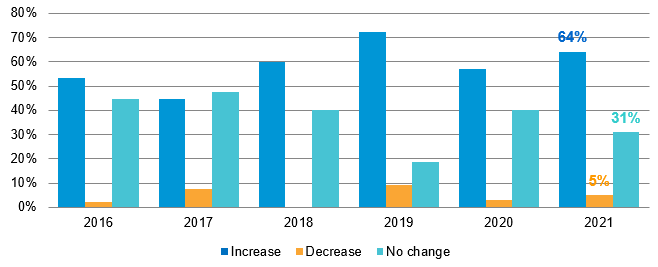

This year sees just under two thirds of respondents (64 per cent) expecting the cost of employing staff to increase in 2021, up from 57 per cent in 2020 but down from 72.2 per cent in 2019. Only 5 per cent of respondents see the cost of employing staff decreasing in 2020, while 31 per cent expect it to remain stable.

Chart 7: Respondents' expectations for the cost of employing staff over the next 12 months

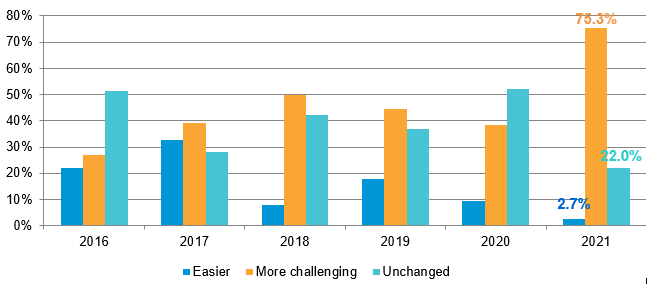

7. Ability to find and retain suitable staff

Three quarters of respondents (75.3 per cent) indicated they are expecting it to be more challenging to find suitable staff. Only 2.7 per cent indicated that it will be easier to find new employees (down from 9.3 per cent from 2020), while 22 per cent are expecting it to remain the same (down from 52.3 per cent in 2020).

Chart 8: Respondents' expectations for the ease at which their businesses will find new employees over the next 12 months

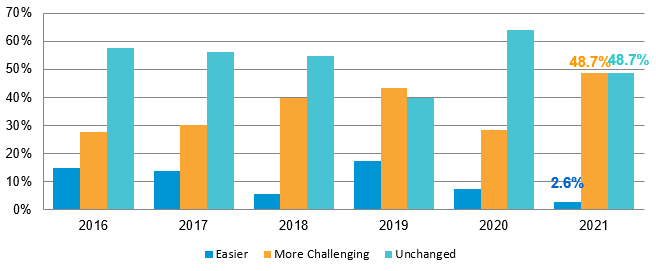

When asked about retaining suitable staff this year, 2.6 per cent of respondents indicated that it will be easier, while just under half (48.7 per cent) are expecting it to be more challenging or remain unchanged.

Chart 9: Respondents' expectations for their ability to retain suitable staff over the next 12 months

These two results point to a tightening of the labour market and the current issues small businesses are reportedly facing in being able to find and retain suitably skilled staff throughout the State.

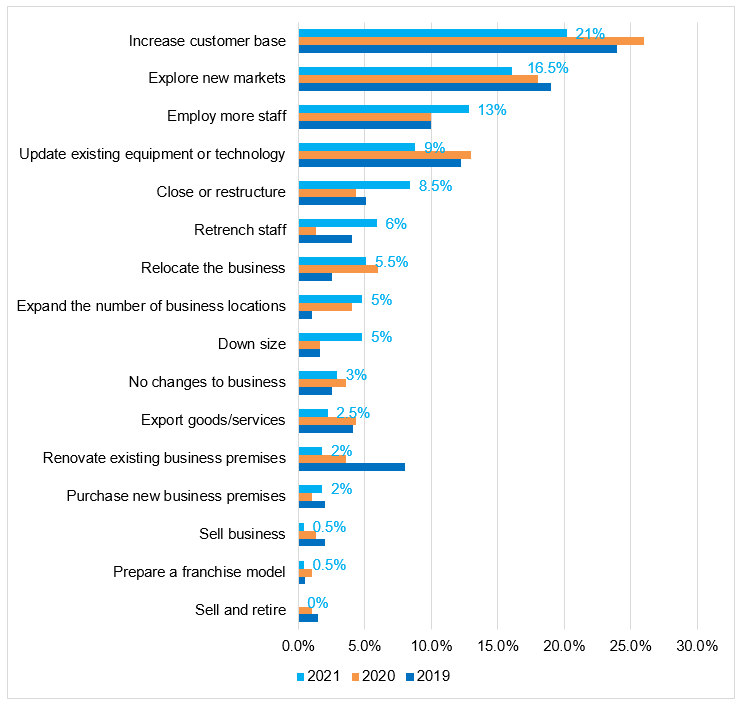

8. Expected changes to the business

Respondents were asked whether they had planned to make any changes to their business during 2021, and were presented with a list of possible options to choose from (multiple responses allowed).

The most common change reported this year (in line with previous years) was to increase their customer base (21 per cent), followed by exploring new markets (16.5 per cent) and employ more staff (13 per cent). The number of businesses that indicated that they are considering closing or restructuring rose to 8.5 per cent, doubling from 4.3 per cent in 2020. In addition, six per cent of respondents expected to retrench staff this year, which is a significant rise from the year before.

Chart 10: Respondents' expected changes to their business over the next 12 months

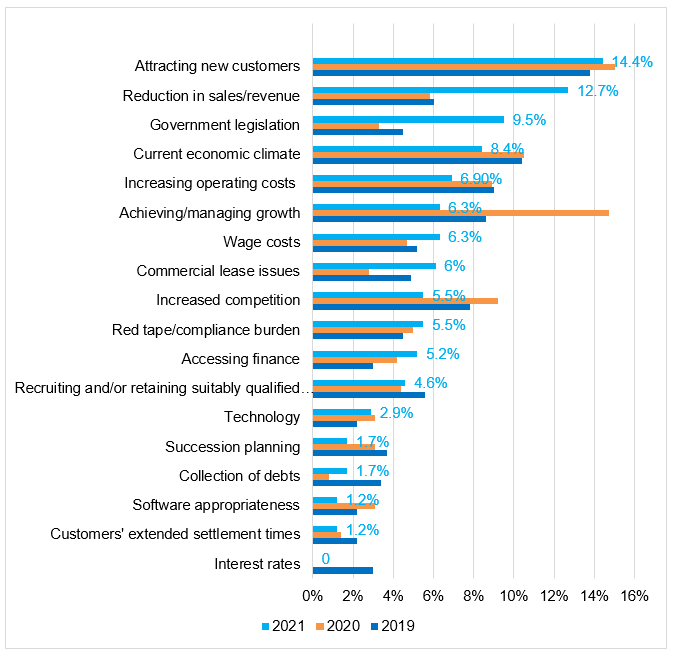

9. Challenges for 2021

Respondents were asked to indicate what their top three challenges would be for 2021 from a list of options. Respondents most commonly reported that attracting new customers would be a challenge for their business (14.4 per cent), followed by reduction in sales/revenue (12.7 per cent) and government legislation (9.5 per cent). Interestingly, the state of the current economic climate was only at 8.4 per cent, which was lower than the previous two years.

Chart 11: Respondents' anticipated challenges for their business over the next 12 months

Interested in having your say?

If you would like to participate in future surveys please contact us.